THE BLOG

Real Estate's Four Great Challenges - Part 5

Wanderer above the Sea of Fog - Caspar David Friedrich - 1818- Hamburger Kunsthalle, Germany

Conclusion

To recap, the ‘Four Great Challenges’ we have discussed in this series are:

Decarbonising real estate

Adapting to the impact of the move to hybrid, distributed and remote working

What to do with a flood of obsolete buildings

Saving our cities from the consequences of the above

Each, on their own, would trouble the capabilities of the real estate industry, but together they represent the start of an industry defining era. To have these ‘in hand’ by 2030 will necessitate a level of technological capability, imagination, commitment, financial prowess and skill that is not yet on display across the industry. There is a big step up required to match these challenges. By 2030, if it succeeds, the industry will be a very different place to today. As we’ve repeatedly said, this is the time for the creative, the innovative, the visionary, to step forward.

To add to the load there is, to plagiarise the best Apple keynotes, ‘one more thing’. And that is the cambrian explosion currently underway around AI, in particular Generative AI.

Generative AI has been a technology bubbling away since 2017, when a team of researchers at Google published a paper entitled ‘Attention Is All You Need’ which introduced a new network architecture, the ‘Transformer’, that reinvented and dramatically improved natural language translation AI. From there on the technique has been built on and expanded in scope until with the launch of Open AI’s ChatGPT, on the 30th November 2022, it exploded into the public consciousness by providing a layman friendly interface to extraordinary computational power. AI had moved from ‘Non coders need not apply’ to the simplicity of typing text. As if by magic, anyone who wants them has been given ‘superpowers’.

And in just two months, 100 million people had tried it out. The fastest growing technology of all time.

Fast forward to March and a much improved version, ChatGPT-4, was released, and in May ‘Plugins’ were added than make the core technology extensible, enabling the easy addition of new capabilities and functionality.

Whilst not a ‘challenge’ like the other four it is a certainty that Generative AI will have a profound impact on the supply and demand side of real estate. How we design, build and operate real estate, and how our customers occupy and utilise real estate, and to what purpose, has a new set of inputs that will ‘transform’ many existing norms.

I would like to emphasise two things.

First, that this is not tech bro hyperbole. In March 2023 Bill Gates wrote that:

‘The development of AI is as fundamental as the creation of the microprocessor, the personal computer, the Internet, and the mobile phone.

It will change the way people work, learn, travel, get health care, and communicate with each other.’

Genuinely, what is going on IS of real consequence.

The second point is that we can learn from history a good lesson in how to leverage technology to raise productivity.

In 1881, Thomas Edison built the first electricity generating stations at Pearl Street in Manhattan and Holborn in London. Within a year he was selling electricity as a commodity, and a year after that electric motors started to turn up in manufacturing plants. But little progress was made for many years. By the turn of the century just 5% of factories were using electric motors, and it wasn’t until the 1920's that electric motors completely took over from steam power, and productivity saw a huge boost.

Why do it take so long? Simply put because the steam powered factory represented a ‘system’ where replacing the power source made little difference to how the system worked. The factory still consisted principally of one giant drive shaft powering a myriad of pulleys, chains and belts. Changing from steam to electric changed almost nothing.

It wasn’t until factories themselves were redesigned, and tasks divided up into different areas, each powered independently by smaller electric motors, that the ‘system’ itself could be rethought and the advantages of the new technology leveraged. Everything needed to change to make changing anything worthwhile.

Now, Generative AI is easier to integrate into the ‘white collar factories’ of today but it will be those who redesign their ‘systems’ who will benefit the most from its use. And of course, an office is nothing if not a ‘system’. So we need to be thinking hard about what this new technology will mean for the work we do, how we do it, and therefore what products and services, and what environments we’ll need as it gets rolled out and improved.

Not least of all, are our customers going to be using AI to remove labour, or augment it? Amongst the more financialised, and those whose incentives push them, we are certain to see much displacement of labour. But might we also see much augmenting of ‘human resources’ by smart and forward thinking companies looking to build a bigger pie? This is not a topic for here, but the answers will further add to real estate’s challenges, one way or the other.

Now back to the conclusions relating to our ‘Four Great Challenges’.

First off, sustainability is a ‘Killer App’. It will create & destroy value at an unprecedented rate. Effectively the need to make assets sustainable is an imperative of the highest order. They will very simply be hard to finance, or sell, if they are not so. ‘Green Premiums’ will disappear as being sustainable becomes the norm amongst assets that anyone wants to buy or occupy, but ‘Brown Discounts’ will grow rapidly amongst assets that no-one either wants or is willing or able to occupy. And as valuations eventually catch up to how to determine what is sustainable or not we’ll see a lot of the mispricing in the market disappear. Many assets are overvalued because their sustainability is not fully understood or priced in. As markets become more sophisticated these errors will disappear. Quite possibly, very quickly. Beware. And be aware.

And 2030 is a ‘Killer Date’ for much the same reason. The regulations implicit in that date will act like a ‘forcing function’ for the industry. As we said, it’s not to be thought of like any other date, but rather as a brick wall we are hurtling towards. Unless you are convinced governments and other authorities will blink as the date gets closer and let people off of complying with what is currently planned you need to be moving fast to position your portfolio.

There is no question of hybrid, remote & distributed work being anything other than here to stay. For the majority of occupiers, a very large percentage, there will be no return to five days a week in the office. It didn’t exist even before Covid, and the inefficiency and ineffectiveness of full office centricity is so obvious to all but the wilfully blind that at least one part of the future is clear. As with the year 2030 this will act as another ‘forcing function’ within the market. And it will benefit those who understand what the market wants, and gives it to them, and will punish hard those that don’t. There is no single ‘office’ market anymore. Plenty will rise as others fall. We are not all in the same boat.

It is not just workplaces that must change though. Companies need to change. They need to update, edit and rewrite their own operating procedures to benefit as they can, and should, from new ways of working. You cannot run a hybrid work policy if your company is designed to be office centric. It does not, and will never work. Many are finding this out now, and mistakingly issuing ever stronger mandates for employees to ‘RTO’ but they are fooling themselves. That will only lose them their best employees. They need to change their ‘system’. They need to redesign the factory.

And in very many cases adopting the principles of #SpaceasaService will be the answer. It will be the defining characteristic of the modern ‘place of work’. Some will outsource their requirements to 3rd party operators but many will also run their own real estate in this fashion. Enabling people to be as ‘happy, healthy and productive’ as they are capable of being is the required output. Whatever it takes.

All of this will mean that obsolescence will be everywhere. Either through the inability to achieve sustainability or through simply not being fit for purpose. Not being able to provide customers with what they want. And the scale of this will be huge. Very little office real estate ticks both boxes. Very little.

Which of course is either a massive bug or a massive feature. It will either wipe you out or is the opportunity of a lifetime. There is unlikely to be all that much in the middle. Great space is good. Cheap space is good. Average, middle of the road space is …… nigh on dead.

Most likely we’ll be seeing a lot of refurbishing and repurposing. Refurbishing when the asset is intrinsically attractive, or characterful or a place where people simply like to be, and repurposing when the office days are over. But whatever happens assets will need to be designed for people (or very specific purposes like urban farming). The 7 trends we discussed in Part 3, of what people actually DO want, need to be adhered to. It’s a myth that we do not know what people want. We do. This isn't rocket science. But they do require effort, imagination and a sense of purpose to achieve. What someone wants does not happen by chance.

Everything above just emphasises that our Cities ARE vulnerable. Entering into a vicious circle, a doom loop, won’t actually be that hard. Unless Cities double down on what makes them ‘special’, and just about every City has something that makes it special, they’ll find themselves in a very bad place. If a doom loop sets in it could be decades before things recover. Some Cities never recover.

So it is essential that those in power work exceedingly hard to understand what their ‘customers’ want and then work back to what is required to give it to them. Factors like sustainability, community, innovation, technology, culture and recreation will be front and centre of all this. All the while though the paramount thought needs to be 'what does it feel like to be in a great, human-centric City'. Because if you cannot create this the only way is down.

And finally, for those in PropTech, all these great challenges represent a boom time. PropTech, alongside other technologies, is needed ‘everywhere’. Technology is necessary but not sufficient. Alone, without a great amount of qualitative, human input, it’ll achieve nothing much. But together….. there is no upper boundary.

The only thing left to say is that these challenges make one realise that the real estate industry is bigger than real estate. We sit at the centre of everything, and impact on everything. If you want to change the world, then real estate is the industry for you.

But. These challenges are real, and 2030 really is a brick wall we’re hurtling towards. This is serious, and as the great American poet Robert Frost wrote…..

‘The only way is through’

Good luck!

Real Estate's Four Great Challenges - Part 4

View of Delft - Johannes Vermeer - 1660–1661 - Mauritshuis Museum, Netherlands

This is part 4 in a series of 5 posts looking at the four great challenges facing the real estate industry on the road to 2030.

Part 1 is here

Part 2 is here

Part 3 is here

———————————-

Challenge No 4 is:

How to Reinvigorate our Cities?

In combination, the first three challenges add up to challenge number 4. How are we to steer our cities through all of this change?

The challenges come in three buckets: Economic, Real Estate, and Social.

Economic challenges: With the rise of remote work, there are fewer people commuting to the CBDs each day, leading to a decrease in spending in the area and a potential decrease in business taxes related to buildings. This can lead to a reduction in revenue for businesses and the city itself, which could result in budget cuts for essential services and infrastructure. Potentially starting a vicious circle, a doom loop.

Real estate challenges: The potential obsolescence of office buildings is a major concern for cities, as they are a significant source of revenue and employment. If these buildings become less relevant due to the rise of hybrid, distributed and remote work, it could lead to a decline in property values and a reduction in the city's tax base. Additionally, there is a growing need to decarbonise real estate, which will require significant investment in retrofitting existing buildings and constructing new buildings that are energy-efficient.

Social challenges: The rise of remote work could lead to a reduction in the sense of community and social connection that is often associated with cities. This could lead to a decline in the quality of life for city residents and a potential decrease in civic engagement and participation.

As with obsolescence, challenge number 3, you can view this situation as Good News or Bad News?

This is the Bad News Perspective:

‘These challenges threaten to undermine the economic vitality and social cohesion of cities, and may lead to a decline in public services and quality of life for residents. Without bold action and strategic planning, cities may struggle to adapt to these changes and remain competitive in a rapidly changing global economy’

Sounds plausible doesn’t it? Maybe cities have had their heyday. And it’s all down from here. After all, such cycles have repeatedly happened throughout history.

But there is a Good News Perspective

What about if we looked through this lens:

‘there is an opportunity to create more liveable, sustainable, and human-centric cities by embracing technology, investing in smart infrastructure, and fostering a culture of innovation and entrepreneurship. By prioritising initiatives that support public health and well-being, promote sustainability and resilience, and enhance quality of life, cities can attract and retain talent, stimulate economic growth, and create a more equitable and inclusive urban environment.’

Genuinely, we could go both ways.

So I thought the way to approach this might be to think about what would success feel like?

What should it feel like to live and/or work in a great, human-centric city?

If we try and envisage the output we desire perhaps we can work back to what inputs are needed to make it happen?

Once again I’m going to recall the great line from Steve Jobs from 1997 when he said:

“You've got to start with the customer experience, and work back to the technology.”

And just think about what customer experience do we want for everyone in our cities and then work back to the technology, processes, policies, infrastructure and systems we’ll need.

So here are some ideas about how it would/should/could feel to live and/or work in a great City?

A great, human-centric city should ….

‘make you feel safe and secure, with well-lit streets, reliable public safety services, and a sense of community that fosters trust and belonging.’

‘make you feel connected and engaged, with opportunities for socialising, learning, and pursuing your interests.’

‘make you feel healthy and happy, with access to affordable and nutritious food, clean air and water, and green spaces that promote physical activity and mental well-being.’

‘make you feel inspired and creative, with a dynamic and supportive environment that fosters innovation, entrepreneurship, and artistic expression.’

‘make you feel empowered and included, with opportunities for all residents to participate in the decision-making processes that shape their communities’

With these as our outputs what do we need as inputs? And who provides the inputs.

In terms of provision, investors, developers, city governors, and technologists all have a major role to play. Public and private sectors have to work together, as do technologists and the wider business community. No-one can go AWOL with this project.

And in terms of actions to take there are not surprisingly many, but they fit into one of four categories.

First, Sustainable Development.

1. Prioritise sustainability: Make it a key priority in all development projects, focusing on reducing carbon emissions, promoting renewable energy, and increasing energy efficiency in buildings.

2. Promote active transportation: Encourage the use of active transportation, such as walking and cycling, by investing in infrastructure and amenities that make it easier and safer for residents to get around the city without relying on cars.

Secondly, Community and Inclusion.

1. Encourage remote work: Embrace the trend towards remote work by investing in technology and infrastructure that makes it easier for workers to work from home, while also providing incentives for workers to visit the city centre for meetings and social events.

2. Foster inclusion: Ensure that all residents have access to the benefits of urban life, including transportation, and public services, and prioritise the needs of marginalised communities in all development projects.

3. Create policies that support affordable housing: Develop policies and incentives that support the creation of affordable housing, such as subsidies, tax credits, and zoning regulations that encourage the development of affordable housing units.

4. Foster community engagement: Promote community engagement by encouraging residents to participate in cultural events and supporting local initiatives that promote social interaction and civic engagement.

5. Prioritise accessibility: Ensure that cultural and hospitality offerings are accessible to all residents, including those with disabilities and those from marginalised communities, by investing in infrastructure and providing financial support to local organisations that promote inclusivity.

Thirdly, Innovation and Technology.

1. Embrace technology: Leverage technology to enhance urban resilience, improve efficiency, and promote innovation in all aspects of urban life.

2. Enhance public safety: Develop programs and initiatives that enhance public safety, such as community policing and neighbourhood watch groups.

3. Emphasise accountability: Establish clear metrics and evaluation criteria to ensure that development projects are delivering value for the community and meeting the needs of all stakeholders, and hold developers and investors accountable for achieving these goals.

4. Foster entrepreneurship and innovation: Promote entrepreneurship and innovation by supporting startups, incubators, and accelerators that can contribute to the growth of the local economy and the creation of new jobs.

And fourthly, Culture and Recreation.

1. Create mixed-use developments: Encourage the development of mixed-use projects that promote walkability, social interaction, and economic vitality.

2. Create green spaces: Prioritise the creation of green spaces and public amenities that promote health and wellbeing, and help to create a more human-centric urban environment.

3. Foster collaboration: Create partnerships and collaborations among stakeholders, including government agencies, businesses, and residents, to promote innovation, enhance sustainability, and address community needs.

4. Support local artists and cultural institutions: Provide financial and logistical support to local artists and cultural institutions, such as museums, theatres, and concert venues, to promote a vibrant and diverse cultural scene.

5. Create public spaces for cultural events: Invest in the creation of public spaces that can be used for cultural events, such as outdoor concerts and festivals, and encourage partnerships between artists and local businesses to promote economic vitality.

6. Promote local cuisine and hospitality: Encourage the development of local cuisine and hospitality by investing in food and beverage infrastructure and promoting partnerships between local businesses and cultural institutions.

Once one starts thinking about all of this as a massive system problem to be solved you start to see not only the complexity of the human task but the enormous range of technologies that would be needed and also how they might need to interlink.

Maybe the biggest challenge for the PropTech (and wider real estate) sector will be learning how to build for a system rather than a silo. The ‘job to be done’ here necessitates design and system thinking. None of this will happen without a large amount of great tech that works together; the industry needs to demonstrate it is up for this task.

Can we get all of this working together?:

Building Management Systems

Digital Twins

AI (including LLMs providing a natural language interface)

Augmented Reality

Virtual Reality

IoT

Collaboration tools (Zoom, Teams etc plus Built World specific)

Crowdsourcing platforms (talking to and with the community)

Intelligent Transportation systems

Geographical Information Systems (GIS)

Integrations with mobile apps and platforms - Citymapper etc

Smart Infrastructure (Cloud/Data/Traffic/Energy)

3D Printing

Drones

Autonomous vehicles

Smart City Platforms (collaboration, data sharing, engagement)

And then integrate them into all of the inputs required to create a great, human-centric city?

Quite a challenge isn’t it?

Real Estate's Four Great Challenges - Part 3

Jeff Koons installation in Station F, Paris

This is part 3 in a series of 5 posts looking at the four great challenges facing the real estate industry on the road to 2030.

Part 1 is here

Part 2 is here

———————————-

Challenge No 3 is:

What to do with a flood of obsolete buildings?

Challenge number 3 follows on from the previous 2 challenges. Both of which have an inexorable logic that points to a great deal of obsolete space coming down the track. Either because buildings are not, and cannot, meet sustainability targets (or at least have no economically viable path to getting there) or they are simply not suitable for playing host to the types of workplaces we are going to need in the future.

Cushman & Wakefield, in early 2023, issued two reports that are the most honest and realistic I have seen from a real estate professional services company. Both are entitled ‘Obsolescence equals opportunity’ and look at ‘The Next Evolution of Office and How Repositioning and Repurposing Will Shape the Future’ - one from a US perspective and the other from a European one.

As they say the aim is ‘to illuminate the degree to which existing office inventory fails to meet occupiers’ needs for engaging, efficient and sustainable office space. In doing so, we directly acknowledge the bifurcated existing demand-supply imbalance, while also evaluating how much office product could be rendered undesirable by the changing needs of a hybrid workforce.’

The commentary and numbers are striking:

‘the U.S. office sector is facing an unprecedented imbalance in supply and demand—one that will result in an excess of 330 million square feet (3 million square metres) of vacant space by the end of the decade brought on by the impacts of the hybrid work environment.’

This 330 million increases the ‘normal or natural’ level of vacancy by 55%. So hybrid is clearly going to have a big impact.

But they proceed to cite numbers that make your head spin:

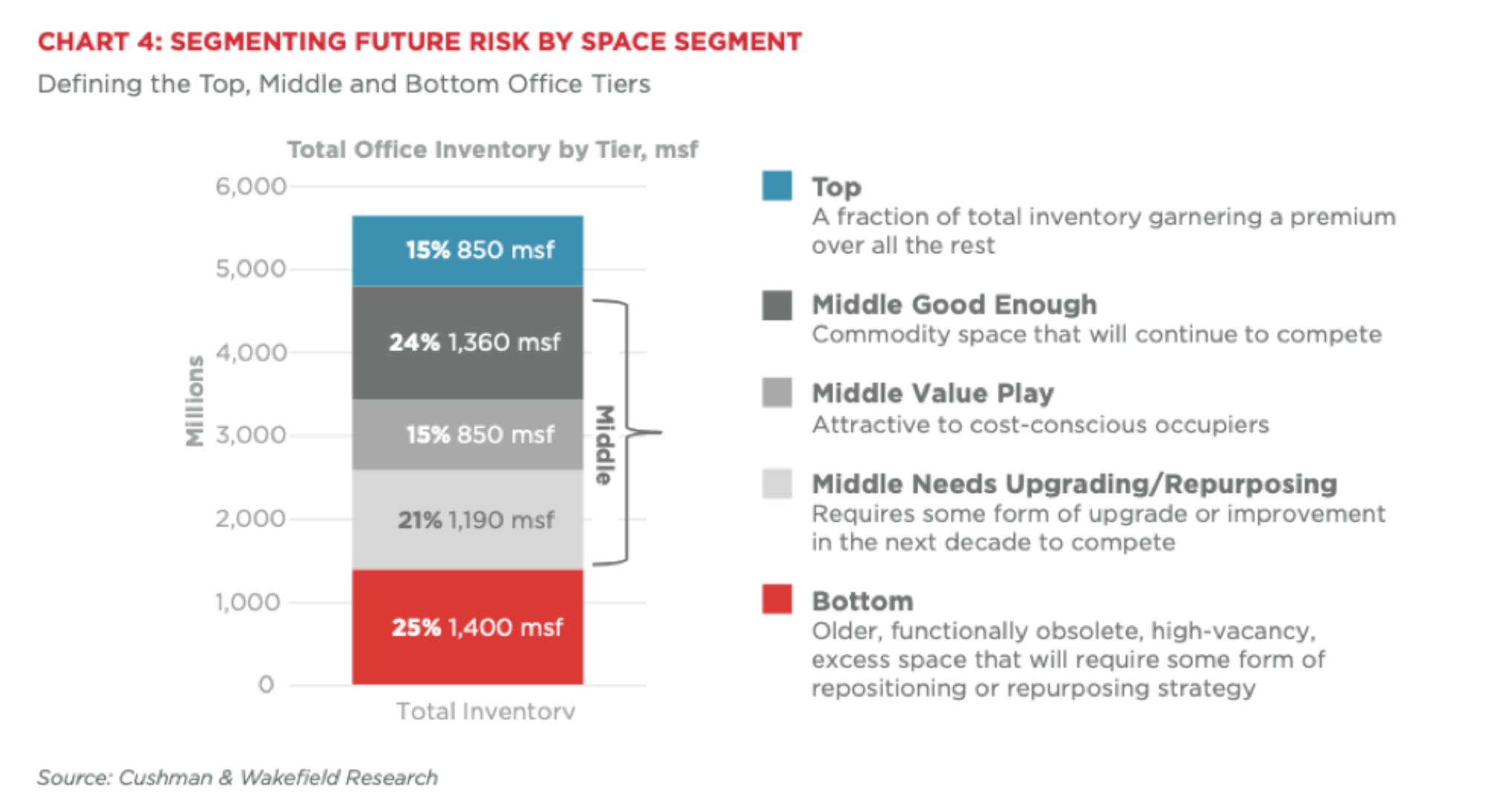

‘By 2030, only 15% of the 5.68 bsf (530 million square metres) of office product will classify within this highly desired category.’ Referring to what they call ‘Top’ buildings.

In reference to the ‘Bottom’ they write ‘Upwards of 25% of office stock throughout the country is growing increasingly undesirable and will need to be reimagined and made relevant for the future.’

And then in the ‘Middle’ they subdivide buildings as ‘Good Enough’ (24%), ‘Value Play’ (15%) and ‘Potentially Obsolete’ (21%).

So that’s 46% of the entire US office stock of 5.56 billion sq ft (530 million square metres) either already obsolete or potentially obsolete.

2.5 billion sq ft (230 million square metres) of obsolete space!

In the Europe report they don’t sub-divide the middle category and boldly state:

‘By the end of this decade, 76% of office stock across Europe will be at risk of obsolescence unless landlords actively invest in improving the quality of their space or look to find alternative uses for it, starting now.’

Now, there are two ways you can look at this. As good news or bad news.

But before we do let’s look briefly at 7 trends that are impacting the types of offices people want, the amount of space they need, and the locations they prefer.

As we discussed in Part 2, the pandemic has led to a massive and structural preference for more choice and flexibility in where people work. So per capita demand for office space is significantly decreasing.

In turn Space Optimisation will follow. In the short term we are seeing a lot of sub-leasing going on, or at least being attempted, but come a lease event it would seem highly likely that, per capita, companies will reduce their space requirements. Also quite likely is companies who have multiple locations consolidating these into one core space. Overall the mantra will be #LessButBetter.

Part of ‘Better’ is space that can effectively look after occupants ‘Health and Wellbeing’. The environmental quality a space offers is more important than it used to be, and likely to get ever more so.

Decentralisation is likely to occur. If employees won’t accept long commutes anymore, then moving offices to be nearer to them, in one form or another, is likely to follow.

Amenities and employee experience matter in a hybrid world. Rule Number 1 is that you must have a reason for people to come to the office. One part of that reason is very likely to include wellness-focused amenities, such as outdoor spaces, fitness centres, and dedicated relaxation areas. This is an increasingly sophisticated area, where pursuing an ‘amenity war’ alone is a dead end whereas designing and implementing an entire end to end ‘experience’ is the hard but correct strategy to adopt.

Top class technology, and integrated technology, is now essential. Remote working has emphasised its need. For an office to be in demand it has to provide reliable internet connectivity, advanced video conferencing facilities, and smart building technology.

And of course Sustainability. As we discussed earlier (Part 1) regulators are insisting on it, investors won’t fund or buy without it, and occupiers, especially the ‘best’ ones, won’t occupy anywhere not deeply sustainable.

All of the above is leading to the huge obsolescence numbers mentioned earlier.

What on earth are we going to do with it all?

Really we have four options:

Reposition: This involves upgrading the existing building to meet current tenant demands and market standards. This option is suitable for buildings with good structural integrity and a desirable location.

Repurpose: If the assets future as an office is no longer viable we need to repurpose it for a different use.

Refurbish: This is similar to repositioning in the sense of involving a lot of structural and systems improvements, but is more about enhancing design and character. This option is suitable for buildings with significant historical or architectural value that are worth preserving.

Or the last option is to demolish the building and start again. This will often be necessary but increasingly unpopular on the grounds of sustainability. You might replace the building with a net zero building but the embedded carbon you create in doing so might offset many decades worth of gains.

What are we likely to see a lot of, and which is likely to appeal to the more creative, innovative real estate people and companies?

I think we’ll see a lot of refurbishment of buildings of architectural merit, design and character. Given that we’ll be needing places of work that catalyse human skills, sacrificing some modernity in favour of beauty and inspiration isn’t a bad bet. Where would you like to work?

And I think repurposing will be huge. Where we give up on offices and do something better with them. This could take many formats.

Here are some:

Coworking or flexible workspaces: Repurpose buildings for coworking or flexible workspaces, catering to freelancers, startups, and project-based needs.

Educational facilities: Convert offices into schools, colleges, or training facilities, utilising existing layouts and infrastructure.

Healthcare facilities: Transform buildings into clinics or healthcare centres, requiring modifications for regulatory requirements and patient needs.

Community or cultural centre: Create community centres, cultural institutions, or non-profit headquarters, adapting large spaces for various purposes.

Data centre or technology hubs: Convert buildings into data centres or tech hubs, requiring significant infrastructure upgrades but offering long-term profitability.

Self-storage or warehouse: Repurpose buildings into self-storage or warehouses, making modifications for storage units, loading docks, and freight elevators.

Urban farming or vertical farming: Create urban or vertical farms, providing sustainable produce sources for local communities, but requiring specialised infrastructure.

Sports or recreational facilities: Transform buildings into sports or recreational centre, utilising large, open spaces from existing office layouts.

So there are options. Pretty much to cover all scenarios. The difficulty might be though that a cookie cutter approach isn’t going to work in this environment. Dealing with obsolescence is going to be a game for the creative.

Whatever you do though we’re going to need technology like never before. We are trying to create spaces that are very human-centric and that requires a lot of human skill. But human skill leveraged by technology is going to be vital. We are deep into high tech / high touch territory.

So what technology will be needed?

Digital Twins: for design & planning, construction & renovation, building performance optimisation, predictive maintenance, tenant engagement and experience, and streamlining facility management processes.

Internet of Things (IoT): Devices & sensors to monitor and optimise energy usage, lighting, HVAC, security, and other systems.

Energy efficiency and sustainability technologies: Green building tech, solar panels, green roofs, energy-efficient HVAC systems, and advanced insulation materials, focussed on reducing a building's environmental impact and contributing to long-term cost savings.

Virtual and augmented reality (VR/AR): Visualise and experience a space before it's built. Useful from design to construction to marketing, to sale or letting.

Artificial intelligence (AI) and machine learning: Everywhere and in everything!

Robotics and automation: Streamlining construction processes, improving safety, and reducing labour costs. Plus building maintenance, cleaning, and security.

PropTech platforms: Integrate, Integrate, Integrate is the new Location, Location, Location. Real estate is a system. We want 'Products', not features.

5G connectivity: What can be done with high-speed, low-latency connectivity? More than many think.

Cybersecurity: Who’s building has been hacked? Who’s quietly paid a ransom? Dull and boring - until it’s you.

So there is a lot going to happen. Millions upon millions of square feet or square metres of obsolete space is coming. We have options, and we have the technology. Or at least will have.

How should we look at this though? It’s definitely a challenge.

But is it Good News or is it Bad News?

This is the Bad News Perspective:

‘The high percentage of obsolete office stock poses financial challenges for landlords and investors, with declining rental income and property values. Redevelopment complexities, environmental impact, and tenant displacement add to the concerns in addressing obsolescence.’

Sounds right doesn’t it? Nothing in that paragraph is not true. It really would not be hard to look at the situation like this. Perhaps doing so is the rational thing to do.

But there is a Good News Perspective

What about if we looked through this lens:

‘The looming challenge of obsolescence paves the way for visionary developers and investors to seize the moment and redefine the urban landscape. Embracing the transformation, they can create vibrant, sustainable, and future-proof spaces that foster innovation, collaboration, and a sense of community. This metamorphosis will breathe new life into cities, making them more resilient, adaptive, and inspiring places to live, work, and play.’

Here’s to the visionaries: your time is now!

Real Estate's Four Great Challenges - Part 2

The Harvesters by Pieter Bruegel the Elder - 1565 - Metropolitan Museum of Art, New York

This is part 2 in a series of 5 posts looking at the four great challenges facing the real estate industry on the road to 2030.

I am available to present the entire series in person: So far I'll be doing so in London, Copenhagen, New York, Washington DC, Miami and Vienna. Contact me if you'd like to book an event.

-------------------------------------------------------------

Challenge No 2 is:

The rise of hybrid, remote and distributed working.

In order to understand where we are today we need to remind ourselves of the actualité of where we were pre pandemic.

In 2019 it was easy to say what an office was, and what it was for.

The general consensus about 'the office' was that it was a physical space where employees would go to work during set hours.

It was seen as the primary location for work and the place where employees would interact and collaborate with colleagues.

The office was a critical component of the corporate culture.

From the perspective of investors and landlords the office was a valuable asset that could generate stable rental income and potentially appreciate in value over time.

And for most corporate occupiers the office was the central hub of their business operations.

In short ‘Work’ revolved around the office.

And for many people the office had real benefits:

Such as:

Face-to-face interactions with colleagues and the ability to collaborate in person.

Opportunities for networking and building relationships with colleagues.

Access to office resources and amenities, such as equipment and specialised spaces.

A sense of structure and routine in their workday, and the ability to separate work and home life.

And opportunities for socialising and team-building with colleagues.

Though the downsides were pretty much as you would expect.

Commuting to and from the office, which could be time-consuming and stressful. And expensive.

Distractions and interruptions from colleagues or noise in open-plan office environments.

Lack of privacy and personal space in open-plan office environments.

Feeling constrained or limited in their work environment, particularly in smaller offices.

And the difficulty balancing work and personal life, and feeling like work was taking over their personal time.

Nevertheless, despite the downsides, going to the office was seen as the default or standard mode of work, and many companies had policies in place that required employees to be physically present in the office during set hours.

Co-working and other flexible office options were available in 2019, but they were not yet as widespread or popular as they are today.

Co-working spaces, in particular, were still a relatively new concept, and were primarily used by freelancers, entrepreneurs, and startups.

These options began to gain popularity amongst larger companies and corporate occupiers, but across major cities we were only ever looking at low single digits percentages of workspace being ‘flex’.

And then, in early 2020 Covid struck, which forced office based companies to move to remote work in a matter of weeks.

This raised many concerns at the time. Employers were worried about:

Decreased productivity and effectiveness in a remote work environment, due to distractions and interruptions, difficulty maintaining focus, and other factors.

Challenges with managing and monitoring employee performance and engagement, due to the lack of face-to-face interactions and the potential for decreased communication and collaboration.

The potential for decreased collaboration and communication between team members, which could impact the quality of work and the ability to achieve goals.

Technical issues related to remote access to company resources, such as limited or unreliable access to high-speed internet and VPNs, and a shortage of necessary hardware and software.

The impact of remote work on employee well-being, particularly as many employees were suddenly facing new challenges related to work-life balance, isolation, and mental health.

All these concerns were what put a break on working away from the office pre pandemic as well. Simply put it all looked a bit too difficult. A day at home here and there was fine but essentially most companies were very much designed around the office.

And to a large extent employees tended to be concerned about the same things.

So, after we all had no choice but to relocate to our homes and away from our offices - how did this all pan out?

Were these early fears validated?

How did companies deal with those five key areas of concern?

Well, as it turned out, at least for the better managed companies, there were and are ways to redesign how we work:

To counter the potential for decreased productivity and effectiveness, employers utilised new tools and technologies for communication and collaboration, such as video conferencing software and project management tools. You no doubt remember the mass rapid adoption of Zoom. They also established clear expectations and goals for employees, and provided additional support and resources to help employees adapt to the new work environment.

Challenges with managing and monitoring employee performance and engagement were dealt with by adopting new performance management strategies and tools to help managers monitor employee performance and engagement in a remote or hybrid work environment. They also provided additional training and resources to help managers effectively manage remote teams.

To keep teams working well together good employers encouraged ongoing communication and collaboration, gave people the tools necessary and developed new processes and workflows. They also offered more flexibility in terms of work schedules and locations, allowing employees to work from home or other remote locations as needed.

Technical issues related to remote access to company resources were solved by investing in new IT infrastructure and security protocols, and providing additional support and resources to help employees access company resources from home.

Good employers prioritised employee well-being, mental health, and work-life balance through empathetic management. They worked hard at understanding who might be affected in what ways and then offered the support and resources necessary to deal with situations as they arose.

In a nutshell companies that were successful in making remote work effective invested in new tools and technologies, established clear communication and collaboration processes, and provided additional training and resources to help employees and managers adapt to the new work environment.

Some companies of course did not fare so well. And this was primarily because they did not do what well managed companies did.

Inadequate management practices and lack of proper support and resources are at the root of almost all failures to make working away from the office work.

But the overall reality is that the fears employers, and to an extent employees had about not working together in an office largely turned out to be imaginary. For most people, and for most tasks, remote working….. worked.

The cold turkey necessity brought on by Covid taught the world that companies did not NEED an office to get work done.

Those things most of us disliked about being in an office: commuting, distractions and interruptions, the lack of privacy and personal space, the constraints of a work environment and the difficulty juggling work and personal life did not HAVE to be endured. Work could get done, without these downsides.

The two things employees learnt, and cannot unlearn, is that commuting does not need to be a daily fixture throughout their entire working life, and that choice and flexibility is life altering.

Commuting, flexibility and choice: Less of the former and more of the latter. Please.

This is Challenge Number 2 because this is what everyone wants.

And they know it is possible and they are not going to give it up.

Now of course just working from home is, for the large majority of people, not enough. There are things people enjoyed about offices and there are things they want to do in them.

Most of us like face to face time with our colleagues, we want to build networks and relationships, we want to learn, we want to feel connected to others, and we want to socialise with them.

What we’ve really done is found out what we would like to do where. What tasks we can best do here, and what tasks we can best do there.

Now we are in the post Covid era and not restricted to only working from home, just about everyone is moving to a hybrid way of working. With X days in the office, and Y days ‘somewhere else’.

This is clearly harder to manage than either when we were all in the office, or all at home, but like adapting to working from home, all the issues are ‘known knowns’ and educated, well resourced and trained managers should have no trouble dealing with them.

In 2019 everyone new what the office was for. In 2023 that purpose is very different. We’ve learnt a lot. We can take all the upsides from pre covid, and manage away all the downsides. That’ll leave us with a very different marketplace, and a very different way of working.

The challenge is in managing it all. Optimising our companies, enabling our employees to be happy, healthy and productive, and restructuring our real estate to act as a catalyst for great work. Not just as somewhere to go.

The essential point is that you cannot successfully run a hybrid company if your operating model is based on being office centric.

The post Covid world necessitates not just re-imagined offices but re-imagined companies. The good and best companies know this and are reaping the benefits. The badly managed companies are mostly reaching for office mandates based on zero interaction with employee needs.

There is only one place this will lead to. We are going to see the split between well and badly managed companies getting wider and wider.

This is data from research by ‘The Future Forum’, which is well respected, organised by Slack, and in this case draws from a survey of 10,243 workers across the U.S., Australia, France, Germany, Japan, and the U.K., conducted from November 16 to December 22, 2022.

Using the UK as an example you can see that we are very much in a hybrid world, and the desire for location and schedule flexibility is very high.

What is also worryingly high though is the percentage of people likely or very likely to be looking for a new job. 27%. Against a global average of 24%. That’s a lot of churn.

Which may partly be a function of burnout.

Which appears to be on the rise. Across the world, burnout is increasing - 42% of the workforce is reporting burnout.

So something is clearly amiss. Not all of which of course will be workplace related but the important statistic to end with is this one:

’53% of those who are dissatisfied with their level of flexibility say they are burnt out compared to 37% of employees who are satisfied with their level of flexibility.’

That is enough of a gap to just reiterate the point that choice and flexibility, along with the desire for less commuting, really is at the heart of how we should be thinking about workplaces.

And why challenge number 2 is not going away anytime soon.

I’d like to leave you with this chart from Gallup looking at engagement at work within the US. Only some 32% of people are fully engaged at work, whilst 18% are actively disengaged.

The role of real estate in engagement is a developing area I think. As we move to being a service rather than a product industry we will inevitably see ‘operators’ adding layers of additional services that aren’t specifically real estate related but that enhance the experience of specific real estate.

We shape our buildings, and then they shape us.

As someone once wisely said:)

Real Estate's Four Great Challenges - Part 1

John Martin The Great Day of His Wrath 1851–3 - Tate Britain, London

This is part 1 in a series of 5 posts looking at the four great challenges facing the real estate industry on the road to 2030.

I am available to present the entire series in person: So far I'll be doing so in London, Copenhagen, New York, Washington DC, Miami and Vienna. Contact me if you'd like to book an event.

-------------------------------------------------------------

Many people talk about challenging times, speed of change, and ‘how not to get left behind’.

Mostly though the substance of their arguments are relatively trivial and could have been written at any time over the last 40 years. Much change is actually rather slow, disruption is limited and the same old same old companies carry on as they always have.

But occasionally certain industries are hit with tumultuous change. Tech being the obvious example. In a few generations we’ve gone from mainframes, to PCs, to smartphones. And from client-server, to local networked applications to everything being in the Cloud.

And the undisputed, impregnable industry leaders, those whose power was ‘too great’, suddenly found themselves as also rans. IBM got trashed by Microsoft, who got trashed by Apple. And everyone perhaps is now going to get trashed by Generative AI, and new superstar companies like OpenAI.

When platforms change, leaders change. Every dog has its day.

But ….. it takes something big, really big, to fundamentally redesign winners and losers in an industry. Incumbents can handle most threats, but tsunamis are tsunamis. Sometimes resistance is futile. You can’t buck the market.

In evolutionary biology they call these moments punctuated equilibriums, where a species splits into two distinct species, rather than one species gradually transforming into another.

I’m wondering if the real estate industry is at just such a moment, especially the commercial sector.

Four massive challenges need to be faced, between now and 2030, now less than seven years away.

Do you remember 2016?

North Korea was conducting ballistic missile tests, Donald Trump was elected US President, David Bowie, Prince, and George Michael died, the Olympics took place in Rio, Game of Thrones was released, …… and of course a quite mad Britain voted for Brexit.

And none of this feels very long ago does it?

But this is just the time we have left before 2030.

There are projects being discussed today that might not open until 2030.

It’s not even the average duration of the UK peak-to-peak and trough-to-trough real estate cycle, which is around eight years.

So, 2030 looms large.

And so it should.

Because you need to think of it not so much as just another year but as a brick wall, an immovable object, that you are hurtling towards. If you hit it, you are in big trouble.

You really mustn’t hit it.

To avoid the carnage you need to address the four challenges.

Which are:

Decarbonising the built environment

Adapting to the impact of the move to hybrid, distributed and remote working

Repositioning and repurposing a flood of obsolete buildings

Saving our cities from the revenue crash and other consequences of the above.

2030 is the deadline because legislators have already decreed it is, and because it’s a pivotal point on the journey to a carbon neutral planet by 2050. We have to get to point X to get to point Y. And 2030 is point X.

Challenge Number 1

So let’s look at decarbonising the built environment. Or to put it more personally 'our assets'!

First off, what’s the urgency?

In March 2023, the IPCC published the ‘AR6 Synthesis Report: Climate Change 2023’ and it can be summed up as follows:

‘The viability of humanity living within planetary boundaries rests on the actions we take in the next seven years. There’s no time to lose to keep to the target of limiting the global average temperature to below 1.5°C.’

They state “There is a rapidly closing window of opportunity to secure a liveable and sustainable future for all.”

And here are some of the main findings:

Human-caused climate change is already affecting many weather and climate extremes in every region across the globe – with widespread loss and damage to both nature and people.

GHG emissions will lead to increasing global warming in the near term, and it’s likely this will reach 1.5°C between 2030 and 2035.

We are currently at around 1.1°C of warming and current climate policies are projected to increase global warming by 3.2°C by 2100.

To keep within the 1.5°C limit, emissions need to be reduced by at least 43% by 2030 compared to 2019 levels, and at least 60% by 2035. This is the decisive decade to make that happen.

The IPCC has “very high confidence” that the risks and adverse impacts from climate change will escalate with increasing global warming.

Implications of global warming:

There are many well known implications of this:

Extreme weather events such as Hurricane Harvey in the US in 2017. This Category 4 hurricane made landfall in Texas and caused unprecedented flooding in the Houston metropolitan area. 50 inches of rain in some areas led to widespread flooding that affected millions of people.

68 direct deaths resulted, and between $85 billion and $125 billion in economic damage. There were also numerous oil spills, chemical plant explosions, and the release of toxic pollutants into the air and water.

Climate scientists believe climate change made floods from Hurricane Harvey up to 50 per cent worse.

Rising sea levels would seem to be an inevitability and many cities are particularly vulnerable, such as Venice, Rotterdam, Copenhagen, London, Hamburg, Miami, New Orleans, New York.

We’ll see a loss of bio diversity and ecosystems, and already are. The dramatic decline in bee populations is an example of the impact of biodiversity loss on human life. The loss of these essential pollinators could lead to reduced crop yields and higher food prices, affecting global food security.

Climate change reduces food and water security. The ongoing Syrian civil war, which began in 2011, has been partially attributed to food and water insecurity caused by a severe drought between 2006 and 2011. The drought led to crop failures and the death of livestock, forcing many rural families to migrate to urban areas in search of work and resources. This influx of people, combined with existing social and political tensions, contributed to the outbreak of civil unrest that ultimately escalated into a full-scale conflict.

These consequences are well now and much discussed, but there are second and third order consequences that we tend to miss, or don’t consider.

For example, climate change impacts can lead to disruptions in global supply chains, reduced agricultural productivity, and increased costs associated with natural disasters. These disruptions can exacerbate existing economic inequalities and have significant implications for global trade, investment, and economic growth.

Resource scarcity and the impacts of climate change on food, water, and energy security can lead to increased competition for resources and potential conflicts between nations.

The psychological toll of climate change can lead to increased rates of anxiety, depression, and post-traumatic stress disorder, particularly amongst those most affected by climate change.

Cultural and historical sites can be lost due to sea-level rise, extreme weather events, and other environmental changes. These impact on peoples cultural identity and communal heritage.

We could reach a time of feedback loops and tipping points that amplify warming and cause potentially irreversible damage. For example, melting permafrost can release large amounts of methane, which is a potent greenhouse gas. One action acts as a flywheel for the other.

And then there is societal unrest and inequality: The uneven distribution of climate change impacts can exacerbate existing social inequalities, leading to increased poverty, social unrest, and political instability. Disadvantaged communities and countries are often more vulnerable to climate change and have fewer resources to adapt, deepening the divide between the "haves" and “have-nots”.

All of this can come back to bite us.

But there is more. At the City level the real estate industry itself could be impacted by another set of potential consequences. Such as an increase in flooding and storm surges causing significant property damage, increased insurance premiums, and decreased property values in flood-prone areas.

Urban heat islands can develop that tend to have higher temperatures than surrounding rural areas due to the concentration of built surfaces and human activity. These can lead to higher energy demand for cooling, increased air pollution, and potential health risks for residents.

Recent examples include the Western North America heat dome of 2021, Tokyo in 2020, Melbourne in 2019, and Karachi in 2018. All experienced extreme and persistent temperatures and hundreds of fatalities.

We’ve already mentioned water scarcity but droughts and reduced freshwater availability due to climate change can strain water resources in cities, leading to increased water costs and potential restrictions on usage.

This can impact the development and management of real estate properties, particularly in water-intensive sectors like landscaping, agriculture, and industry.

Intense heat can also highlight infrastructure vulnerabilities such as ageing transportation networks, water and sewage systems, and energy grids.

That simply cannot cope.

Increasingly real estate developers and investors may need to factor in the costs of upgrading or adapting infrastructure to cope with this.

Another second order impact can be changing demographics as people migrate to less vulnerable areas or seek to escape the negative effects of climate change.

Think about at risk coastal areas, or agricultural land in ‘overheating’ regions.

Or areas lacking in resilient and adaptive infrastructure.

Over time, people, in potentially huge numbers, could be on the move from all such places.

Anyone with long time horizons needs to think hard about what real estate you buy or sell. There’s very much winners and losers here. There are areas that’ll benefit greatly from climate change. Or at least relatively so.

Cities are bound to react with regulatory changes and incentives. They may implement more stringent building codes, zoning regulations, and incentive programs to encourage energy efficiency, resilience, and sustainability in the built environment.

Real estate developers and property owners will have to adapt accordingly, but there are certainly going to be many opportunities for sustainable development and retrofitting.

Maybe harder to deal with will be issues around reputation and social responsibility: As public awareness of climate change and its impacts grows, companies and investors may face increasing pressure to demonstrate their commitment to sustainability and climate resilience. This of course can be a bug or a feature - all depends on your assets doesn’t it?

Which segways neatly on to the role of the built environment in global greenhouse gas emissions.

And here is where our problems start:

According to the United Nations Environment Programme (UNEP), the built environment, including building construction and operations, accounts for approximately 38% of total global energy-related CO2 emissions.

Buildings consume around 36% of global energy, primarily for heating, cooling, lighting, and powering appliances and equipment.

According to the IEA (the International Energy Agency):

‘To align with the Net Zero Scenario, carbon emissions from buildings operations need to more than halve by 2030’.

It’s that year again. 2030.

And so far we are doing really badly:

‘Following the easing of Covid-19 restrictions, in 2021 energy demand in buildings increased by nearly 4% compared with 2020 (or 3% compared with 2019), the largest annual increase in the last decade.’

But the sticks have been primed. If we don’t do it naturally then we’ll need to be forced to.

And all across the world there are increasingly big sticks being designed to force significant change.

For example, in New York City there is Local Law 97 which requires large buildings (over 25,000 square feet) to meet certain carbon emissions limits starting from 2024. Buildings that fail to comply will face financial penalties. The law aims to reduce the city's building-related emissions by 40% by 2030 and 80% by 2050.

In the EU, amongst other regulations there are those encompassed in the ‘European Green Deal’ such as increasing the greenhouse gas emissions reduction target to at least 55% by 2030, compared to 1990 levels, and the "Renovation Wave" strategy, which aims to at least double the annual energy renovation rate of residential and non-residential buildings by 2030.

In the UK there is the Climate Change Act 2008 which sets a legally binding target to achieve net-zero greenhouse gas emissions by 2050, with an interim target of reducing emissions by 68% by 2030 compared to 1990 levels.

Also, there is the Minimum Energy Efficiency Standard (or MEES) which sets a certain energy performance standard that increases over time. In April 2023 one level was introduced but this will increase in 2027, and then again in 2030.

Currently around 85% of buildings do not meet the 2030 standard.

Getting there will necessitate upgrading 15 million square feet (1.4 million square metres) of space per annum. Yes per annum. Every single year. And that’s just London offices.

And penalties for failure are going to be high. In the EU they are set by each member country, but in New York they involve meaningful financial penalties, and in the UK you’ll simply not be able to legally rent out your property.

So 2030 really is looking like a brick wall that will be very painful to hit.

If we hit it it’ll bad for the planet, for our society, for our cities, for our businesses, and for our finances.

However, even if these arguments aren’t a good enough reason, there are others, because there is an increasingly powerful causal relationship between building energy efficiency, operating costs, and asset value.

Energy-efficient buildings obviously use less energy which equates to reduced operating costs for heating, cooling, lighting, and other building systems. Which equates to higher net operating income, which equates to higher value.

Avoiding regulatory penalties and obsolescence isn’t a bad move.

Being more in demand likewise. The market already wants, and will pay for, buildings that meet the highest sustainability standards. Aligning with their environmental values and goals is already a priority for the best companies. By 2030 not doing so will make you a pariah.

And of course financing is the strongest argument of all. Investors will not fund, and will not buy, unsustainable buildings. Public institutions are already pretty much unable to do so, but by 2030 will there be any financing available for unsustainable assets, that is not accompanied by massive write downs in value?

Today there are clear green premiums for the most sustainable buildings, but by 2030 these may ease. To be replaced by ever growing brown discounts.

All of which is a massive boon for the PropTech industry. A massive market, a huge problem, and a brick wall of a deadline.

Which goes to explain why, in the US, there will be 20 X the public investment in the green economy this decade than there was in 1990-1999.

Yes, 20X!

And investment across Europe, and the rest of the world is, or will be, growing equally dramatically.

For the simple reason that we cannot fix this problem without technology. Yes we probably need to change our behaviours somewhat but frankly that is unlikely to happen at a really fundamental level. Human nature would get in the way. But we most certainly will adopt new technologies in place of old ones.

Carrots and sticks, and new technology, will save us. Or nothing will.

So we will be seeing huge potential for a wide range of new technologies. Such as:

Passive design strategies. So building orientation, shading devices, natural ventilation, and natural lighting.

Building envelopes: high-performance insulation, windows, and air sealing can minimise heat loss and gain, reducing the need for mechanical heating and cooling.

Adaptive reuse and retrofitting: ‘the most sustainable building is the one already built’. 80% of 2050’s building stock already exists. And it all need decarbonising.

Sustainable materials: timber, recycled steel, and low-carbon concrete

High thermal mass materials: Such as stone or concrete, can help store and release heat, stabilising indoor temperatures and reducing energy consumption

Advanced insulation materials, such as aerogel, vacuum insulated panels, and phase change materials, can provide better thermal performance and reduce heat loss or gain.

Energy-efficient HVAC, lighting, and appliances

Building automation and controls: energy management systems, and smart controls can optimise building performance, monitor energy consumption, and identify opportunities for further efficiencies.

On-site renewable energy generation: Integrating renewable energy sources, such as solar photovoltaics, wind turbines, or geothermal systems, can help reduce a building's reliance on grid electricity and lower its carbon footprint.

Energy storage: Incorporating energy storage solutions, such as batteries or thermal storage, can help manage energy demand, store excess renewable energy generation, and provide backup power during grid outages.

Electrification: Fully electrified buildings lead to reduced GHG emissions, energy efficiency and improved air quality.

The year 2030 is a real crunch point regarding sustainability and real estate. It is, in reality, a wicked problem. It is also probably the single largest opportunity space in technology. Decarbonising the largest asset class in the world, against a timetable that will bite us back hard unless we meet it, is our challenge number 1.